san antonio sales tax chart

The County sales tax rate is. Wayfair Inc affect Texas.

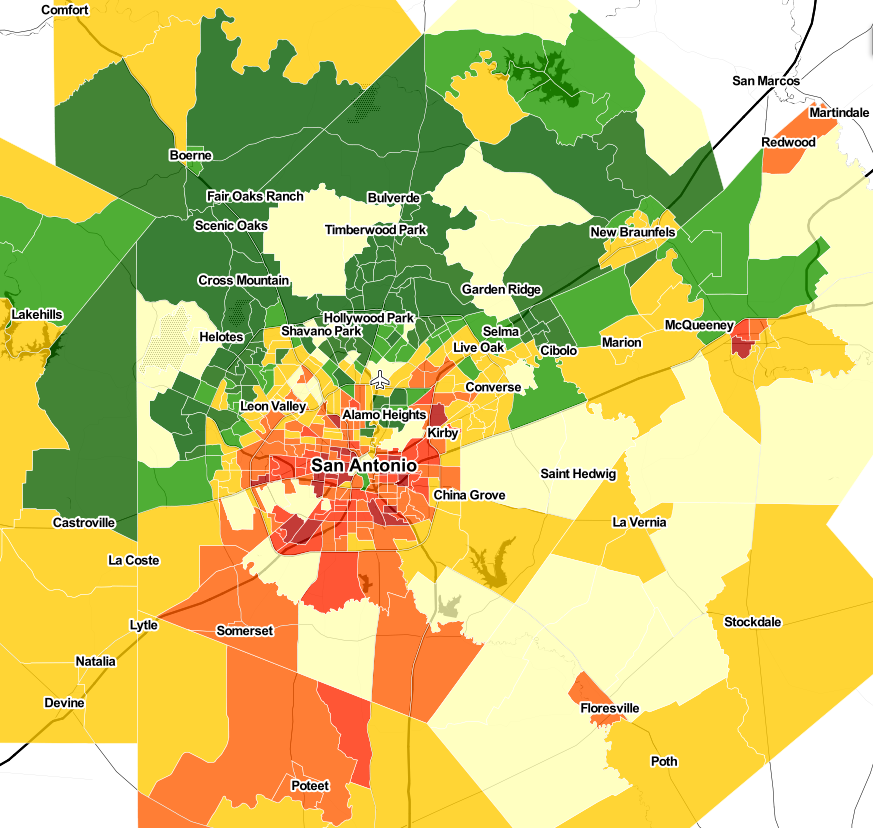

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

The San Antonio sales tax rate is.

. The combined rate used in this calculator 825 is the result of the Texas state rate 625 the San Antonio tax rate 125 and in some case special rate 075. This is the total of state county and city sales tax rates. Method to calculate San Antonio Heights sales tax in 2021.

The sales tax rate does not vary based on zip code. Texas has a statewide sales tax rate of 625 which has been in place since 1961Municipal governments in Texas are also allowed to collect a local-option sales tax that ranges from 0 to 2 across the state with. Does Texas have sales tax.

6 rows The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and. Known as The Last Frontier Alaska is the most tax-friendly state. The San Antonio sales tax rate is.

San Antonios current sales tax rate is 8250 and is distributed as follows. This is the total of state county and city sales tax rates. Sales Tax in San Antonio Texas is calculated using the following formula.

DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business. The County sales tax rate is. Sales tax in San Antonio Texas is currently 825.

4 rows The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125. There is base sales tax by Texas. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate.

On-Time Sales Tax Filing Guaranteed. The Bexar County sales tax rate is 0 however the San Antonio MTA and ATD sales tax rates are 05 and 025 respectively meaning that the minimum sales tax you will have to pay in Bexar County and specifically San Antonio when combined with the base rate of sales and use tax in Texas is 825. If this rate has been updated locally please contact us and we will update the sales tax rate for San Antonio Texas.

The San Antonio Mta Texas sales tax is 675 consisting of 625 Texas state sales tax. The average cumulative sales tax rate in San Antonio Florida is 7. The Florida sales tax rate is currently.

Sales Tax Rate s c l sr. Calculator for Sales Tax in the San Antonio. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Which state has no sales tax. The minimum combined 2022 sales tax rate for San Antonio Florida is. The state sales tax rate in Texas is 625 but you can customize this table as needed to reflect your applicable local sales tax rate.

The sales tax rate for San Antonio was updated for the 2020 tax year this is the current sales tax rate we are using in the San Antonio Texas Sales Tax Comparison Calculator for 202122. The current total local. What is the sales tax rate in San Antonio Florida.

Counties cities and districts impose their own local taxes. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. The average cumulative sales tax rate in San Antonio Florida is 7.

The minimum combined 2022 sales tax rate for San Antonio Texas is. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. Sales and Use Tax.

The current total local sales tax rate in San Antonio TX. Within San Antonio there is 1 zip code with the most populous zip code being 33576. Texas State Sales Tax Rate 625 c.

The 78216 San Antonio Texas general sales tax rate is 825. Sales Tax Chart For San Antonio Texas. Name Local Code Local Rate Total Rate.

Fill in price either with or without sales tax. Did South Dakota v. San Antonio is located within Pasco County Florida.

The average sales tax rate in California is 8551. Below is a table of common values that can be used. Did South Dakota v.

1000 City of San Antonio. 0500 San Antonio MTA Metropolitan Transit Authority. 4 rows San Antonio TX Sales Tax Rate.

San Antonio is located. The results are rounded to two decimals. 0125 dedicated to the City of San Antonio Ready to Work Program.

This includes the sales tax rates on the state county city and special levels. US Sales Tax Texas Bexar Sales Tax calculator San Antonio. 0250 San Antonio ATD Advanced Transportation District.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Object moved to here. Ad Seamless POS System Integration.

San Antonio FL Sales Tax Rate. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The Texas sales tax rate is currently.

FL Sales Tax Rate. San Antonio collects the maximum legal local sales tax. The current total local sales tax rate in San Antonio TX is 8250.

Understanding California S Sales Tax

New Mexico Sales Tax Rates By City County 2022

San Antonio Texas Tx Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

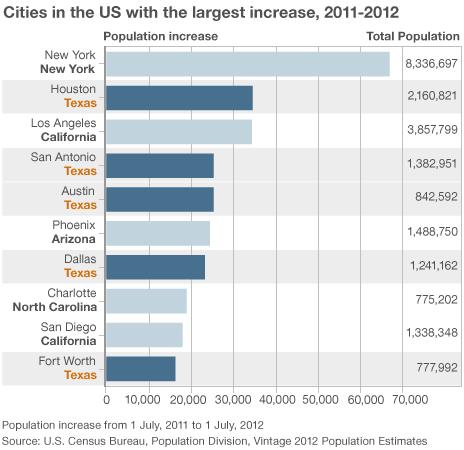

10 Reasons Why So Many People Are Moving To Texas Bbc News

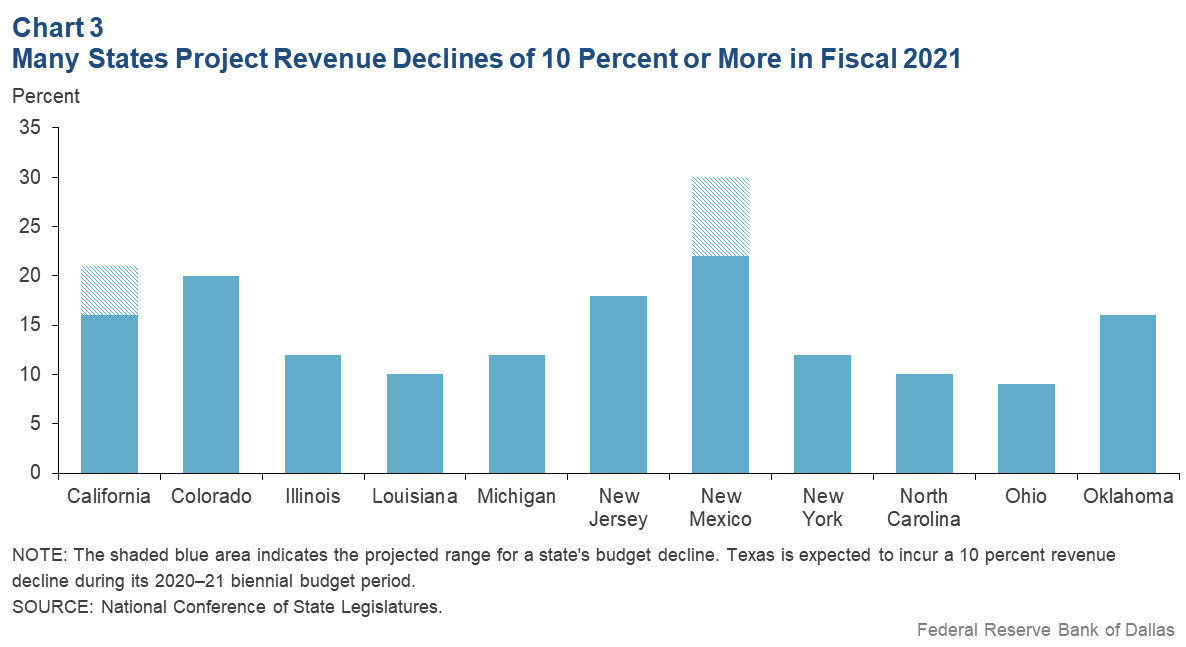

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Understanding California S Sales Tax

Understanding California S Sales Tax

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

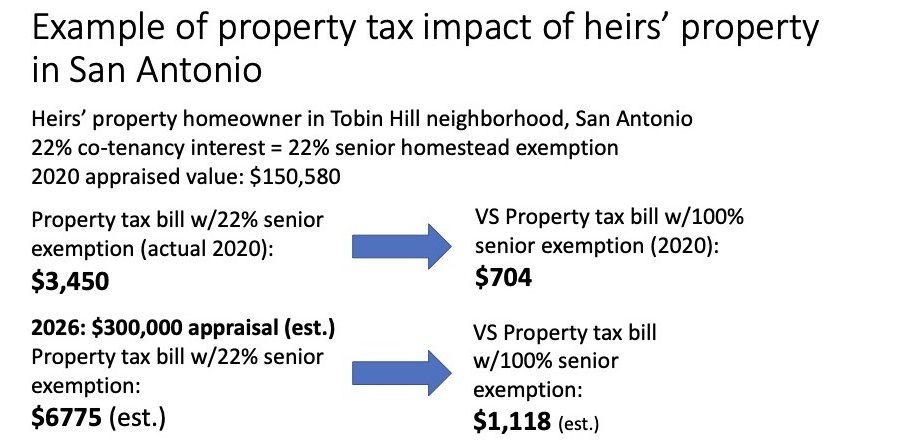

Property Tax Relief Programs Don T Reach Many Homeowners Of Color Shelterforce

Gross Domestic Product By Metro County Austin Chamber Of Commerce

How School Funding S Reliance On Property Taxes Fails Children Npr

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Understanding California S Sales Tax

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The Most And Least Tax Friendly Major Cities In America